CENTRAL, Texas — On Friday, small business owners hit hard by the coronavirus crisis could begin to apply for nearly $350 billion in loans through the Economic Rescue Plan which was passed by Congress in March.

The loan is also known as the Paycheck Protection Program. It is for small business owners with fewer than 500 employees. Small businesses like Waco Cha can get up to 2.5 times their total monthly payroll through the Paycheck Protection Program.

The bubble tea shop says they really care about this community and plan to apply.

"We have about two people who are full time with us,” Waco Cha Owner Devin Li said. “It's pretty much their only income, so it will allow us to keep paying our employees."

There are about 1,800 banks who are a part of the U.S. Small Business Association. Some banks have already announced they won't be ready to process the loans.

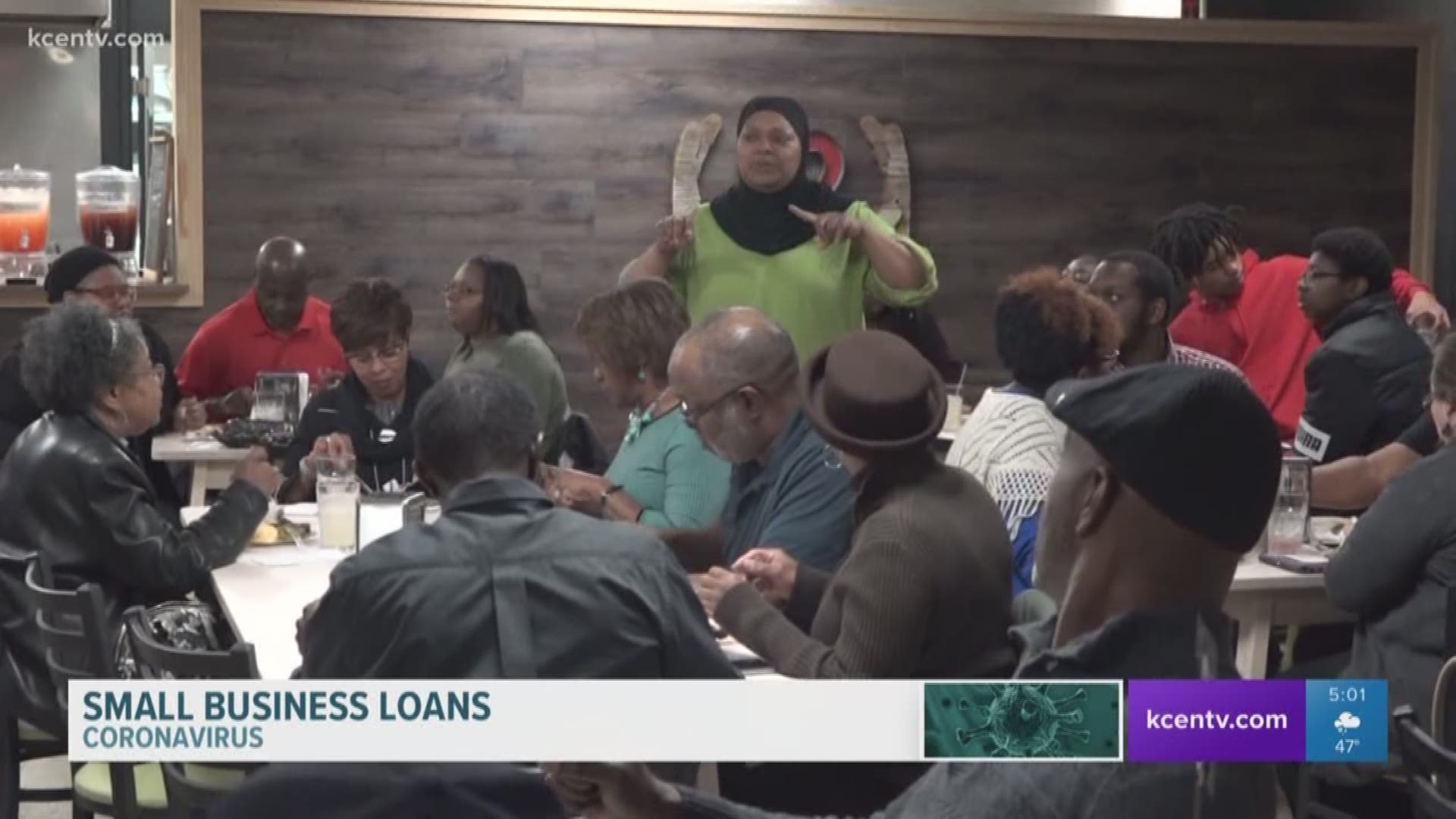

That worries Luvina Norwood-Sabree who owns So Natural Catering in Harker Heights.

"I’m fearful that if we don’t start doing any business soon that I’m going to lose my business," Norwood-Sabree said.

Mike Dent of Wings Pizza and Things in Temple said his sales are down around 40 percent. He has already applied for the loan but worries about how long it will take to actually get the funds.

"There's a lot of people hanging on by a thread right now,” Dent said. “It may be three weeks down the road before people start seeing some relief and that may be too late for some people."

The program is currently set to run through June 30. The loan will be fully forgiven if the funds are used for payroll costs, interest on mortgages, rent and utilities.

Also on KCENTV.com

- Chick-fil-A in Temple shut down while employee awaited COVID-19 test results set to reopen

- Central Texas COVID-19 live updates | Bell County reports no new cases, sees signs of flattening the curve

- Walmart regulating the number of customers in stores due to coronavirus outbreak

- Central Texas seniors under stay-at-home orders can receive meals thanks to $304,000 grant