TEXAS, USA — Homeowners in Central Texas have started to receive their annual reappraisal notices for their property and some have already started the appeal or protest process.

Appraisal value increases have typically been somewhere around the normal inflation rates, which would be anywhere between two and four percent per year. However, most Central Texans are still seeing more than a 10-percent increase in their property values.

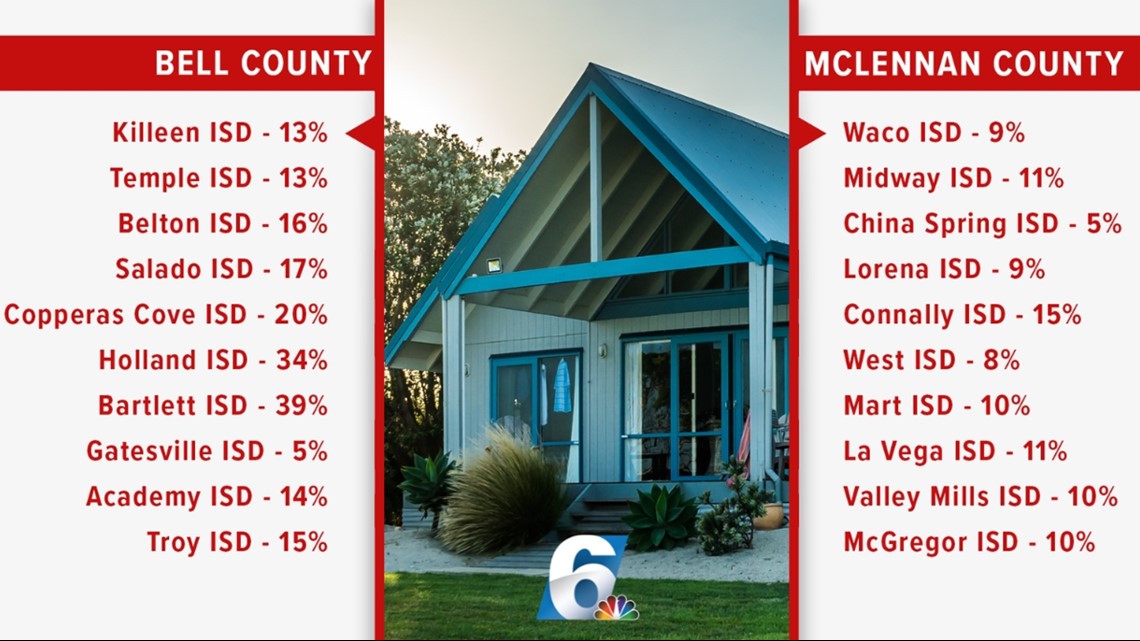

Here is a breakdown of the median percent increase in property values based of the school district you would be paying taxes to. It doesn't include all of them. The data was provided by the Bell County Tax Appraisal District and the McLennan County Appraisal District.

County wide, the median percent increase of property values in McLennan County was 10 percent. Connally ISD saw the biggest jump and that's because the Appraisal district is trying to make up for being too low on values the previous year.

"We have to fix it for 2023, and if we don't then for 2024 the school district will start losing funding and so that's that's what we're trying to avoid at all cost," said Joe Bobbitt, the chief appraiser for McLennan County.

Bell County property owners saw a larger increase in values compared to McLennan County. Chief Appraiser Billy White said the median percent increase for single family residential is about a 14-to-15-percent increase.

"Our job is to be in market, not unnecessarily what they want to sell it for or what they think it should be taxed at," White explained. "Our job is to be as accurate as possible with those."

White says low inventory, being less expensive and relatively attractive is what is driving Bell County property values up.

Both appraisal districts encourage you to visit with their offices if you disagree with your notice, they want to make sure the values are correct and accurately represent the market.

"We're not the bad guys," Bobbitt added. "We're not trying to get the values up just for no reason. We want to be correct. That's ultimately what we want is this value to be correct and so the whole appraisal process is is more to set the fairness."

The first thing you should do when you get your notice is think about if you can sell your home for the value listed by the appraisal district. If not, you should call or visit your appraisal district.

"If you think there's issues with the property value sent out, or it's too high -- more than what you would sell it for, then you should come in and talk to us and if there's actual issues with your property that we could fix then we want you to come talk to us," White explained.

Last year Bell County had around 21,000 protests of property values. White is expecting a similar turnout this year. Residents in Bell County will have different protest deadlines, you should check your notice for that date.

Meanwhile, the protest deadline in McLennan County is May 15. You can find your protest form on the back of your notice.

Even though notices with increased appraisals are out, the tax rate is still not set.

"If you don't agree with the value, you may not agree with the tax rate because a lot of people it's the taxes that they don't like," Bobbit added.

"Just because you received a large, small, huge whatever the increase was on your property value this year does not necessarily mean that the taxes are going to increase at all." White said.

Leaving the burden still unknown, as it will be up to the taxing entities to make the final decision.