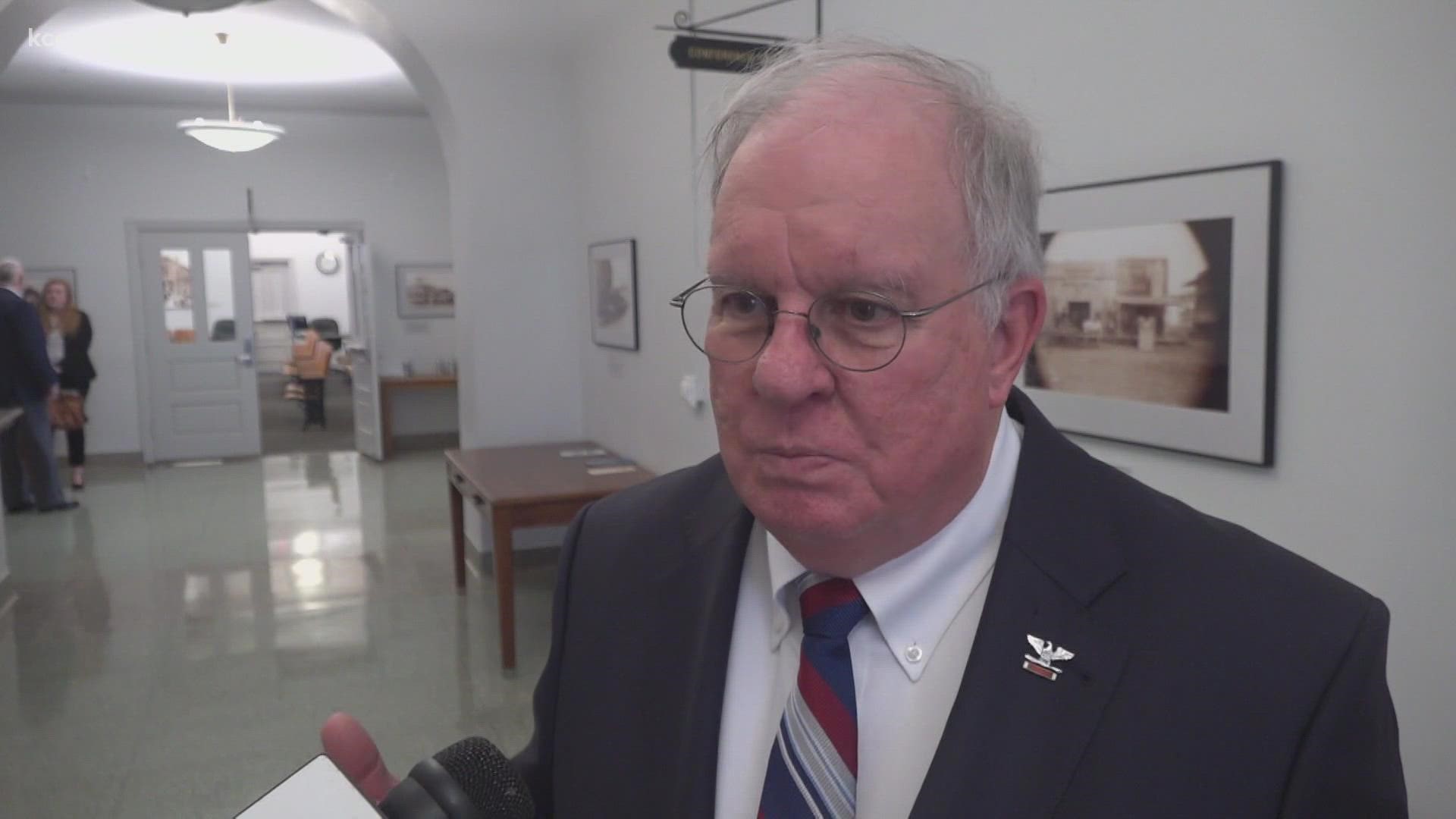

BELL COUNTY, Texas — Texas Representative Hugh Shine is glad to see disable veterans getting a tax break, but the 2010 statue that grants homestead property tax exemptions to 100% disabled veterans, and their surviving spouses, is now causing a practical problem for cities with high veteran populations.

"Cities have a requirement based on population to have a certain number of police officers, to have fire protection, if you've got 15 to 20 percent of your budget that you can't collect taxes on, but you've got the state mandating you have to do this for law enforcement and fire protection, the only choice you have... is going to the voters to increase your property taxes," Shine said.

Cities don't want to do this, of course, but the gap in the tax base is now significant. Shine told 6 News that the City of Killeen is now losing as much as $8 million dollars in property tax revenue to this exemption.

He said Harker Heights is losing around $2 million dollars and Bell County as a whole could be losing as much as $20 million dollars.

Shine has filed bills in the last three legislative sessions, which are only biannual in Texas, to try and get relief funding for disproportionately effected cities. His bills, which tried to make a pool of money available for affective cities, never got though the Texas Senate.

"It's never flown in the Senate. We pass it out of the House, it get's to the Senate, it goes nowhere. We need another course of action," Shine said.

Now, Shine working to get support from Pete Flores who is running for Senate District 24. Flores joined Shine today at a conference in Bell County to discuss the issue. He said he is now working multiple angles to find more funding for affected cities.

"Veterans deserve this property tax and the state owes them that honor. We're looking at alternatives, we're looking at courses of action, and over the next nine months that's what I'll be working on on the house side and once we get into June, ill be sharing all of this data not only with representative Buckley's office but at that point in time with our senator elect," Shine said.

6 News spoke to Flores after the conference. He said he would be working with shine to file a companion bill in the Senate after Shine files a bill in the House.

"Filing a bill, that's a big step, and then to be able to take it though the process with colleague in the Senate," Flores. "We'll move together in concert to get this bill though."

Shine told 6 News he has a workgroup exploring three different options on how this relief could be funded and what has the best chance to solve the problem. They have nine months to put the bill together. Shine said he hopes to start sharing the resulting bill with colleagues by June and Flores would be a key ally.

"We have to have his support in the Senate. We as house members have to have an advocate force in the Senate that is very dogmatic in making sure the message is there and getting support from other Senators.

Shine said the 100 percent disabled tax exemption has led to a loss of 350 Million dollars across the state.

Also on KCENTV.com: