KILLEEN, Texas — A local veteran is warning everyone about a potential scam that could have cost him his entire monthly benefits check.

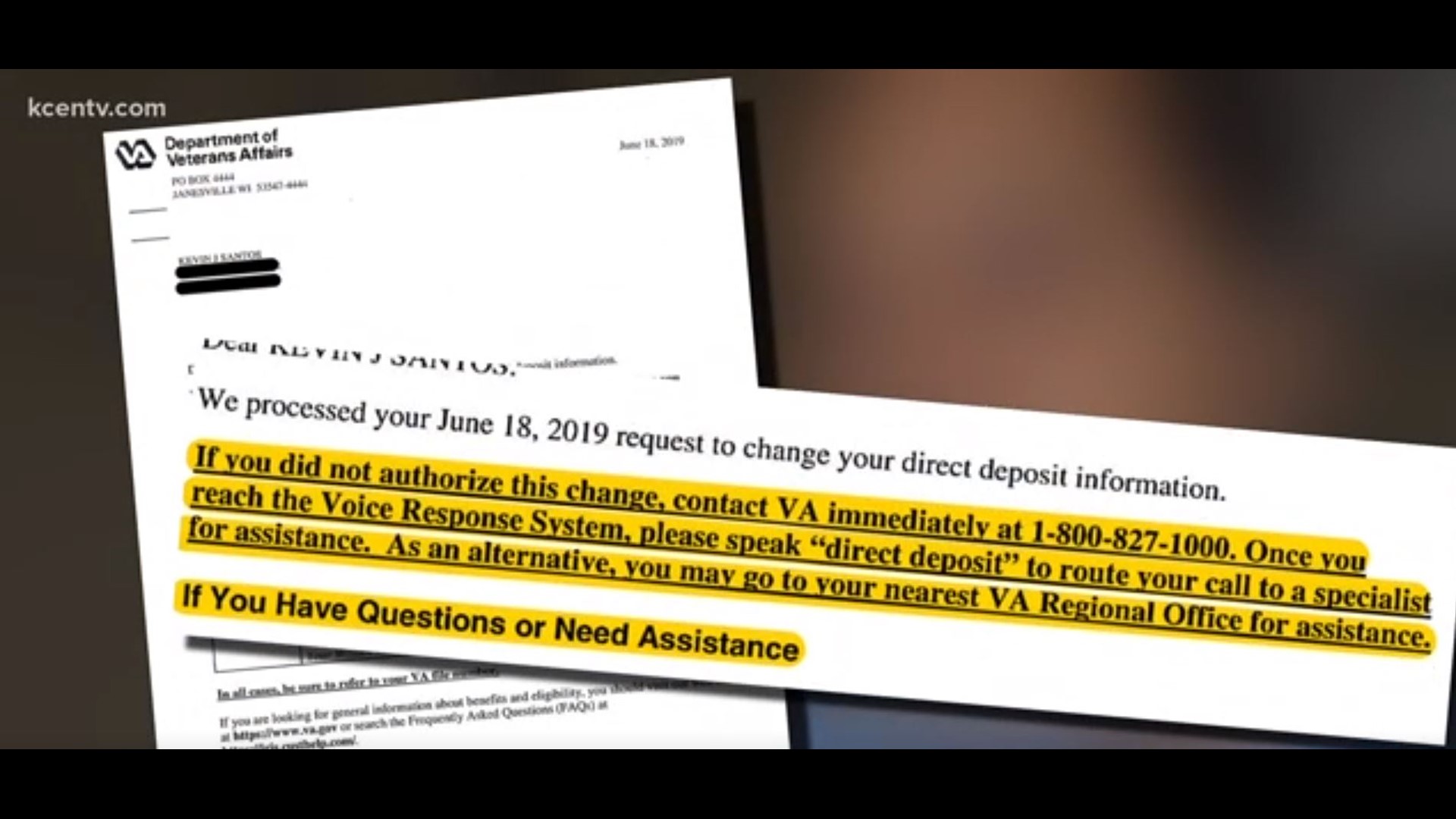

Kevin Santos said he checked his mail last week and received a letter from the Department of Veteran Affairs Waco office, saying his request to change his direct deposit was successful.

He never made that request.

"I mean, it was baffling and it stirred up a lot of emotions," Santos said. "I mean, I am expecting my money on the first like everyone else and now it's going to be late."

Adam Price, the Regional Director of the Better Business Bureau in Waco, said this isn't uncommon.

"First thing to realize is, is this a scam or is this legitimate," Price said. "Scams and identity theft can target anybody and everybody. Unfortunately, this is something we have to deal with into today's technology."

The letter Santos received told him to call the number listed if he never requested the change. he said he did so immediately.

After a long wait, he said things were corrected and he will now be getting his money. Now, he's waiting on his finances to arrive so he can pay his bills.

Price said data breaches are hard to prove in terms of how it started, but people must stay vigilant and know what is happening with their personal information. He said this is especially important in the society we live in online, with plastic debit cards and how busy we can get day to day.

When it comes to surviving in an online-driven world, Price said a few things will help you survive the onslaught of scammers trying to steal your money and identity.

"Shred your documents," Price said. "There's dumpster divers out there and they're not looking for food. They are looking to steal your personal information."

So, how do identity theft scams work? Price said with enough information, a scammer can take over your identity and commit a wide-range of crimes. He said scammers can make false applications for loans and credit cards, withdraw money from your bank account and can also sell your information to others.

Check your credit reports regularly. You have the right to check them once per year with each of the three major credit bureaus.

Price said to secure all your personal documents at home, preferably under lock and key, and to minimize personal information on checks. Be alert of phishing scams. These can come in different ways, including via social media. Using strong passwords is key, so avoid using your birth date, mother's maiden name, or the last four digits of your social security number.

Changing your passwords frequently and using different pass codes for each online account will help deter those looking to steal your identity.

Price also said if any company you do business with is compromised, there are tips on what to do if your personal data is compromised and what to do if your credit or debit cars is compromised as a result.

"Just be careful our there, it's a dangerous world," said Santos. "There's scams going left and right."

Price said that Santos did everything right when he received the letter and people need to understand it's a different world.

"A gentleman's handshake agreement doesn't exist anymore," Price said. "We are a very trusting culture but we have to get to a place where we protect ourselves first."

Other stories on KCENTV.com: