Heads up! You only have a few days left to file your 2019 taxes.

The tax-filing deadline was extended to July 15 from April 15 due to the coronavirus pandemic.

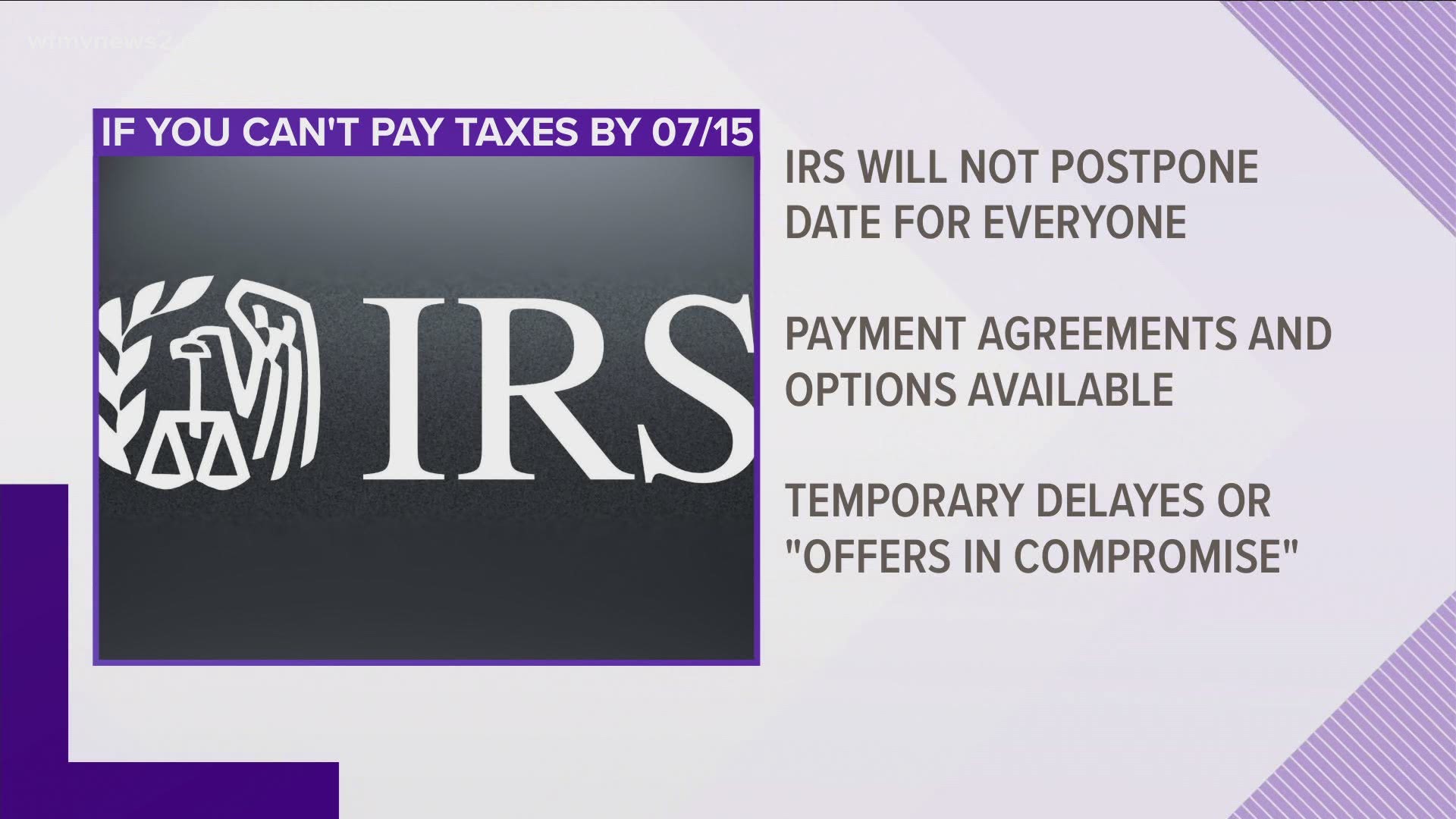

Taxpayers must file or seek an extension by the new deadline or face a penalty.

If you have yet to file and are uncomfortable with going inside a building, the IRS said it has services on its website that can help and you can file online. The IRS website also has information on requesting an extension or making a payment.

The fastest way to receive a refund is to file electronically and use direct deposit. There are delays in processing paper tax returns due to limited staffing so this is another reason you should choose to electronically file your taxes.

What about estimated taxes?

Taxpayers who make estimated quarterly tax payments have until July 15 to make the payments for the first and second quarter. Those were originally due on April 15 and June 15 respectively.

There are a host of other tax deadlines linked to July 15. Check out the IRS website or reach out to a tax professional for answers to your specific question.