KILLEEN, Texas — In the last year, housing prices have risen an average of $40,000 in the Bell County area and $36,000 in the McLennan County area according to the Texas Real Estate Research Center.

The rising property values mean cities and counties are making more from property taxes. They've made so much more, in fact, that some are now lowering local tax rates.

At the Killeen Council meeting Tuesday evening, City Manager Kent Cagle suggested the council lower the property tax rate for the 2023 budget to $0.6233 per $100 valuation. (See "per $100 valuation" explanation at end of article). This is down from $0.7004 per $100 valuation in 2022.

Even after lowering the tax rate, the city would still have $3.57 Million more to work with than the previous year. Cagle's report said the City of Killeen has actually lowered that rate every year since 2020. If the City of Killeen had a policy of "no new revenue" the tax rate would drop all the way to $0.6059 per $100 valuation.

Cagle also showed the Killeen Council a list of "peer cities" that included Temple, Waco, Copperas Cove, Harker Heights, and Belton and said those cities would likely drop their tax rates as well.

"I can assure you that almost every city on this list, their tax rate will go down some amount," Cagle said.

Cagle said the average cost of a homesteaded property in Killeen, in 2023, was $178,761 versus $158,338 for last year. Even after the increase in value, Cagle said homeowners would see a tax increase of only $5.22 for the whole year under the new lower rate. This means the rate would largely cancel out any tax increase for residents if it went into effect.

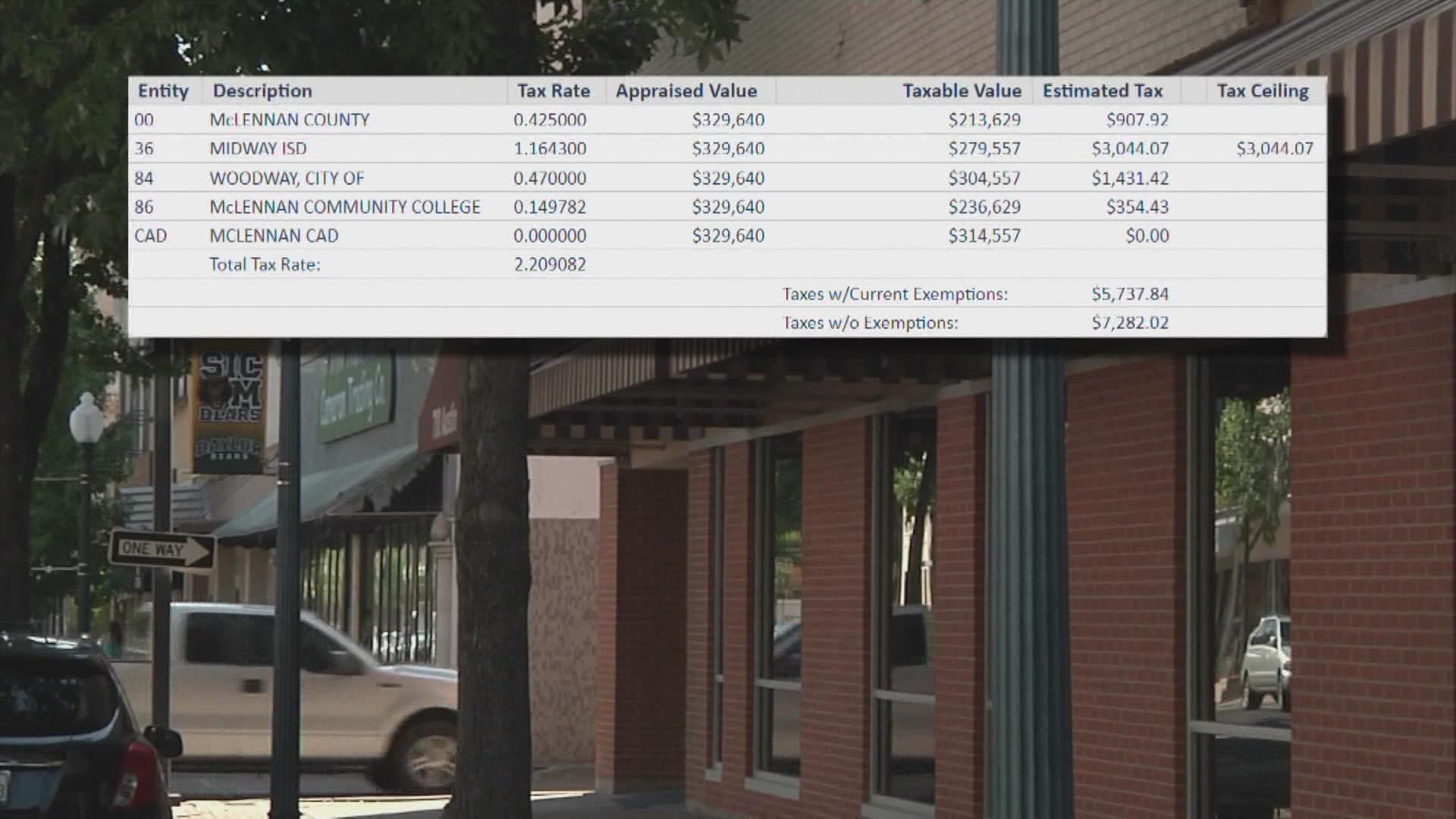

In McLennan County, commissioners adopted a preliminary tax rate of $0.3763 per $100 valuation last week. This is down from the current rate of $0.425 per $100 valuation. There will be a final vote on the rate on August 30.

This would be a "no new revenue" rate designed to collect the same amount of property tax revenue as last year.

McLennan County Chief Appraiser Joe Don Bobbitt told 6 News Wednesday the new rate would cancel out new taxes for some property owners and could even lower taxes for others.

"It will be close to breaking even. With the homestead exemption and other exemptions that have been adopted this year, a lot of taxpayers may see a benefit or a decrease in their taxes. It all depends on which entities they fall under, everyone's situation is a little different, but there will be people that see a decrease in taxes this year even though their home value went up maybe substantially," Bobbitt said.

Many homeowners will likely need to wait and see what local school districts do with their tax rates before finding out how this affects their property tax bill as a whole. Bell County has not released a preliminary tax rate at this time.

Per $100 valuation explanation

Municipalities use "per $100 valuation" instead of showing the actual tax rate to make the figures easier to manage.

A tax rate of "$0.6233 per $100 valuation" means the tax rate is actually 0.006233 per dollar value of your home. If you lived in Killeen, for example, and wanted to know what your taxes would be after this proposed change, simply multiply (0.006233) x (your home value) to get the correct tax amount.

More on KCENtv.com: